What is cryptocurrency, how does it work – and what’s the point?

The PA news agency explains the basics behind one of the buzziest – but worst understood – areas of the financial world.

Cryptocurrency has been around for more than 15 years, and there is more than £1.8 trillion-worth of the stuff floating around on the internet.

Yet for all the tales of rows and riches that have engulfed crypto in recent years, not that many people can tell you what it actually is.

Even fewer can answer the simple question: what’s the point?

The PA news agency breaks it down.

– What is cryptocurrency?

Crypto is a type of digital money designed to be used over the internet. It does not exist physically, like dollars or pounds.

There are many types of crypto, but you have probably heard of the biggest and oldest one: Bitcoin.

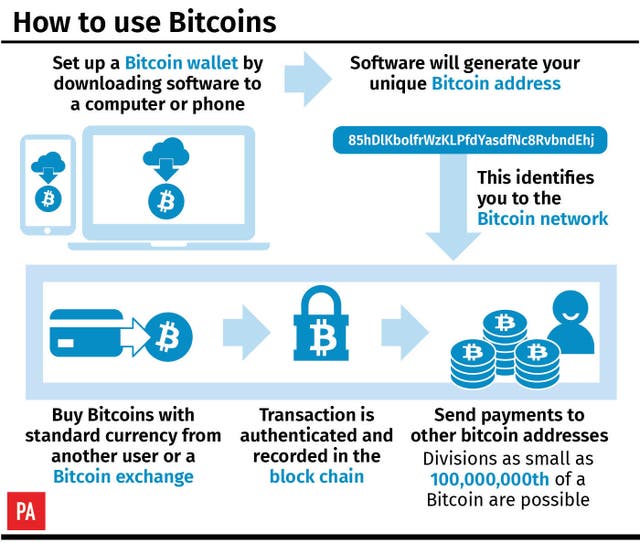

Invented in 2008, a Bitcoin is essentially a computer file which is stored on an app, which functions as a digital wallet. There are many of these apps on the market.

You can send and receive crypto with other people – and it is frequently traded for money. Lots of it.

– How does it work?

Bitcoin is decentralised. That means it is not managed, recorded or stored by any one entity, like a national government or a bank.

Instead, every record is logged on a shared list called a blockchain.

Think of it like an online spreadsheet which no single person controls. Instead, it is shared around people who use it all over the world.

Those people get small financial rewards for keeping the ledger accurate and up-do-date. It is immutable, which means it is virtually impossible to go back and edit previous entries (or “blocks”).

This makes it attractive to people who want to break free of traditional currencies, and the influence that governments, central banks and financial institutions hold over them.

– What’s the point?

While there is a small, growing number of places that accept crypto as a real-world payment method, you’ll struggle if you try to use it to pay for most goods and services in the UK.

But the fact that you do not need to use a bank means that you can use crypto to operate outside the traditional financial system.

This appeals to people who want to send money across borders often, for example, where intermediaries often take a cut on transactions using traditional money.

It also makes it easier to act anonymously. Many crypto service providers do not have the same identity checks as banks.

As a result, it is generally harder to track where crypto has come from or where it is going than traditional currencies.

Unfortunately, that means criminal gangs or even terrorists often use it to launder money. Crypto is also sometimes used to transact illegally with sanctioned countries like Russia.

– Why do some people like it so much then?

Many people love crypto because it is extremely volatile, meaning you can make vast amounts of money very quickly by trading it at the right time.

One whole Bitcoin in October 2023 was worth about £27,000. Just a year later, that has nearly doubled.

Now consider if you had bought dozens of Bitcoins a decade ago, when they were valued at about £260, and you can see why some people are evangelical about it.

In that sense, it is different to investing in traditional assets, like stocks and shares, which are generally much more stable.

– Is it a safe investment?

No. Crypto has already been through several monumental boom-and-bust cycles already, which have done huge amounts of harm.

Millions of people put their life savings into cryptos like Bitcoin thinking it would make them better off.

But huge crashes in value in 2018 and 2022 left people’s finances in ruins – and the fact that it is still relatively unregulated means there have been a lot of scams.

The most high profile was in 2022, when FTX, the crypto exchange founded by Sam Bankman-Fried, collapsed.

Mr Bankman-Fried was later sentenced to 25 years in prison for defrauding customers out of billions of US dollars.

So while Bitcoin is near its record price again now, it is still generally considered extremely risky.

As the old adage goes: never invest more than you can afford to lose.